Ever picked up your prescription and been shocked that a generic drug cost more than you expected? You’re not alone. Many people assume that because a drug is generic, it should be cheap - and in most cases, it is. But sometimes, your generic medication ends up in a higher copay tier, making it cost more than a brand-name drug you’ve never heard of. This isn’t a mistake. It’s by design.

How Tiered Copays Work

Most health plans today use something called a tiered formulary. Think of it like a pricing ladder for medications. Each rung on the ladder is a tier, and each tier has a different copay amount. The idea is simple: encourage people to pick drugs that cost less for the plan - and ideally, for you.- Tier 1: Preferred generics. Usually $0-$15 for a 30-day supply.

- Tier 2: Preferred brand-name drugs. Around $25-$50.

- Tier 3: Non-preferred brand-name drugs. Often $60-$100.

- Tier 4: Preferred specialty drugs. 20-25% coinsurance.

- Tier 5: Non-preferred specialty drugs. 30-40% coinsurance.

Why Your Generic Isn’t in Tier 1

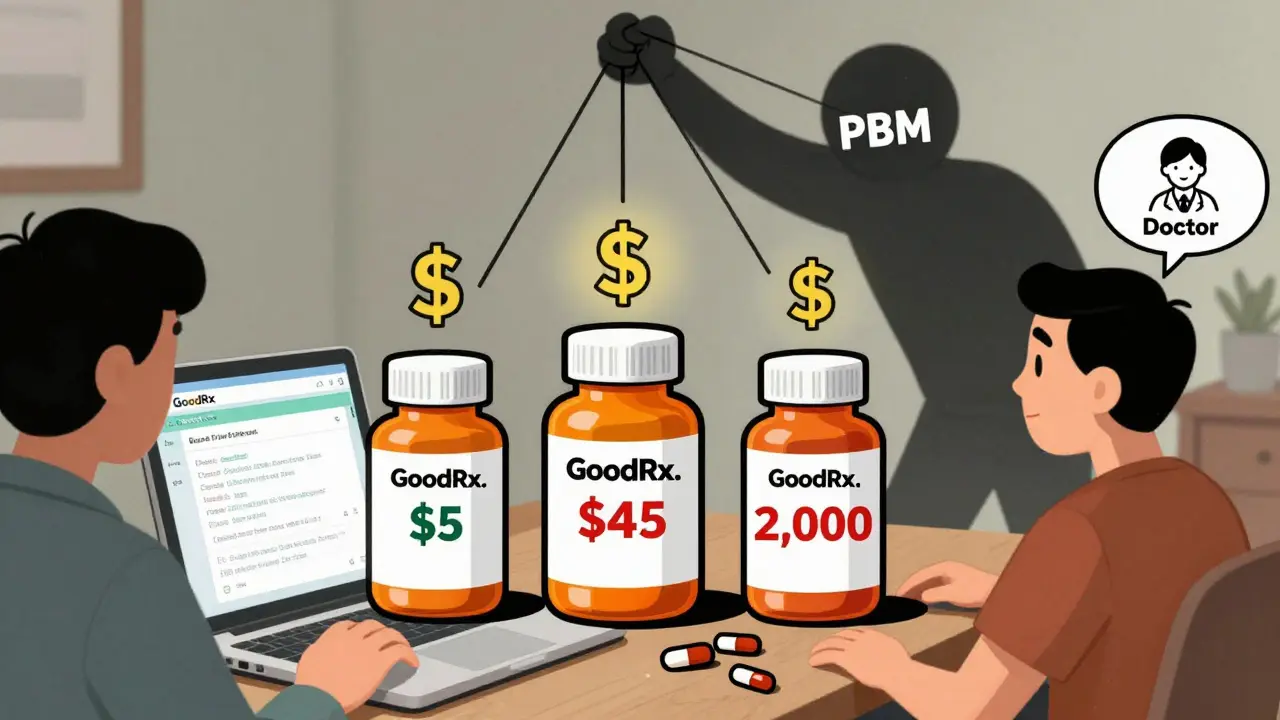

Here’s the part that trips people up: not all generics are created equal - at least, not by your insurance. Say you take levothyroxine, a common thyroid medication. There are dozens of generic versions made by different companies. Your plan might have negotiated a deep discount with one of them - let’s call it Generic A. That version gets placed in Tier 1. But Generic B, which is chemically identical, doesn’t have a good rebate deal with your PBM. So it lands in Tier 2 or even Tier 3 - with a $45 copay instead of $5. This isn’t about quality. It’s about money. As Dr. Dennis G. Smith, former director of Medicaid services, put it: “Preferred status has nothing to do with clinical superiority - it’s entirely about the rebates and discounts PBMs negotiate with manufacturers.” In fact, 68% of the time, a generic drug gets moved to a higher tier because the manufacturer’s rebate deal expired. Not because it’s less effective. Not because it’s unsafe. Just because the deal fell through.Specialty Generics Are the Big Surprise

Then there’s another layer: specialty generics. These are generic versions of very expensive drugs - like biologics used for rheumatoid arthritis, multiple sclerosis, or cancer. They’re still technically generics, but they cost $5,000 to $10,000 a month. Even after the brand-name patent expires, these generics don’t come cheap. Because of their high cost, insurers often put them in Tier 4 or 5. That means you pay 25-40% of the total cost out of pocket. So if your adalimumab generic costs $8,000 a month, your copay could be $2,000. That’s not a typo. And here’s the kicker: you might not even know you’re on one. Pharmacists often switch you automatically to a “preferred” version without asking. You show up for your refill, and suddenly your bill is way higher. No warning. No explanation.

What’s Worse? The Silent Switch

Many patients don’t realize their medication changed until they get the bill. This is called a therapeutic interchange. Your doctor prescribed one generic, but your pharmacy substituted another - one that’s in a higher tier. A 2023 survey by the Patient Advocate Foundation found that 41% of insured adults had experienced this. Of those, 68% said they couldn’t get a clear answer from their insurer about why the cost changed. One Reddit user, ‘PharmaPatient87’, wrote: “My levothyroxine generic went from $5 to $45 overnight. My doctor said all generics are the same. So why am I paying nine times more?” The answer? Your insurer didn’t get a good deal on your version.How to Fight Back

You don’t have to accept this. There are ways to reduce your costs.- Check your formulary. Every plan updates its drug list once a year - usually in October. Log in to your insurer’s website and search for your medication. Look for the tier. See if there’s a lower-cost alternative.

- Ask your pharmacist. They know which generics are preferred. If you’re on a higher-tier version, ask if they can switch you to a Tier 1 option.

- Request a therapeutic interchange. Your doctor can fill out a simple form to request a switch. According to the Medicare Rights Center, this works 63% of the time.

- Use GoodRx or SmithRx. These tools show cash prices and compare them to your copay. Sometimes paying cash is cheaper than using insurance.

- Look into manufacturer assistance. Many drug makers offer programs that cover part or all of the cost for eligible patients. In 2023, these programs helped cover 22% of specialty drug costs.

Why This System Stays

You might wonder: why do insurers keep this confusing system? Because it works - for them. Studies show tiered copays reduce overall drug spending by 8-12%. When people see a $100 copay for a brand-name drug, many choose a cheaper generic. That saves the plan money. And because PBMs get rebates from manufacturers who want to stay on Tier 1, they have a financial incentive to keep the tiers complex. But the system doesn’t always save you money. Sometimes, it just shifts cost around. A 2005 study found that when a diabetes drug moved from Tier 2 to Tier 3, adherence dropped by 7.3%. People skipped doses because they couldn’t afford it.What’s Changing in 2025

Starting in 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 a year. That’s a big deal. But it won’t eliminate tiered formularies. The structure will still exist - you’ll just stop paying after hitting the cap. Meanwhile, some PBMs are simplifying. UnitedHealthcare moved several high-volume generics (like atorvastatin and lisinopril) to $0 copays in 2024. Express Scripts, on the other hand, moved 87 generics to higher tiers last year. The trend? More complexity at the top (specialty drugs) and more simplicity at the bottom (common generics). But the middle - where most people live - stays messy.What You Need to Know

Your generic drug isn’t expensive because it’s less effective. It’s expensive because your insurer didn’t negotiate a good deal on that specific version. And unless you check, you won’t know until you’re at the pharmacy counter. The system is designed to save money - for the plan, not always for you. But you have power. You can ask questions. You can request alternatives. You can use tools to compare prices. Don’t assume the system is fair. Don’t assume your pharmacist knows what’s going on. And don’t pay more than you have to. If your generic costs more than expected - it’s not you. It’s the formulary. And now, you know how to change it.Why is my generic drug in a higher tier than the brand-name version?

It’s not about effectiveness - it’s about money. Your insurer has a rebate agreement with the manufacturer of the brand-name drug that makes it cheaper for them to cover than your generic. The generic you’re taking may not have a strong rebate deal, so it’s placed in a higher tier. This is common with older generics or those from manufacturers who don’t offer big discounts.

Can I ask my doctor to prescribe a different generic?

Yes, absolutely. You can ask your doctor to write a prescription for a specific generic version - one that’s on Tier 1. If they’re unsure which one that is, ask your pharmacist for help. Many doctors will switch your prescription if you explain the cost difference. In fact, 63% of therapeutic interchange requests are approved.

Why does my insurance switch my medication without telling me?

Pharmacies are allowed to substitute a generic version with another - even if it’s in a different tier - as long as it’s chemically identical. This is called a therapeutic interchange. It’s legal, but it’s not always transparent. You should be notified, but many patients aren’t. Always check your receipt or call your pharmacy if your copay changes unexpectedly.

Are there generic drugs that are always in Tier 1?

Not always. But many high-volume, low-cost generics - like atorvastatin, metformin, and lisinopril - are often in Tier 1 because they’re widely used and manufacturers compete to offer big rebates. However, even these can shift tiers if the rebate deal expires. Always double-check your plan’s formulary every year.

What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay (like $15) for a drug. Coinsurance is a percentage of the total cost (like 25%). Tier 4 and 5 drugs often use coinsurance because their prices are so high - you might pay $2,000 on an $8,000 drug. Copays are easier to budget for. Coinsurance can be unpredictable.

Can I appeal if my drug is moved to a higher tier?

Yes. Most plans have an appeals process. If your drug was moved to a higher tier and you’re relying on it, you can request a “formulary exception.” You’ll need a letter from your doctor explaining why the change affects your health. Urgent requests are often decided within 72 hours.

Do all insurance plans use tiered copays?

Almost all do. In 2023, 98% of employer-sponsored plans and 99% of Medicare Part D plans used tiered formularies. Flat copays - where every drug costs the same - are rare now. The tiered system is the standard because it helps insurers control spending.

Is there a way to avoid tiered copays altogether?

Not easily. But you can reduce their impact. Use tools like GoodRx to compare cash prices. Ask about manufacturer assistance programs. Switch to Tier 1 generics when possible. And if you’re on Medicare, remember the $2,000 out-of-pocket cap starting in 2025 - once you hit it, your drugs will be free for the rest of the year.

Pat Mun

February 11, 2026 AT 12:11So I’ve been on levothyroxine for like 12 years, and I swear, my copay goes up and down like a stock market chart. One month it’s $5, next month it’s $47, and no one tells me why. I just assume it’s the pharmacy switching me out. I’ve learned to check my receipt before I leave the counter. If it’s higher than usual, I ask. No shame in asking. Turns out, my plan just lost the rebate deal with the maker of my usual generic. I switched to another brand that’s still Tier 1, and now I’m back to $3. It’s annoying, but it’s fixable. Just don’t ignore it.

Neha Motiwala

February 12, 2026 AT 04:48This whole system is rigged. PBMs are just middlemen who don’t make anything but profit off your suffering. They collude with drug companies to push the most expensive generics into higher tiers so they can squeeze more rebates. It’s not about savings-it’s about control. And your doctor? They’re clueless. Pharmacists? They’re told to switch you automatically. You think you’re getting a deal? You’re getting played. This isn’t healthcare. It’s a casino where the house always wins-and you’re the sucker.

athmaja biju

February 13, 2026 AT 11:44India has a different system. We have generic drugs because we don’t allow patent monopolies like the U.S. Our medicines cost pennies because we prioritize access over corporate profit. Why does America let private companies dictate life-saving prices? It’s disgraceful. You think this is capitalism? This is exploitation dressed up as a business model. If you’re paying $45 for a thyroid pill, you’re being robbed. And the government lets it happen because they’re bought off. Wake up.

Robert Petersen

February 14, 2026 AT 23:36Hey, I just want to say-you’re not alone in this. I went through the same thing with my blood pressure med. Thought I was being charged unfairly. Called my insurer, asked for the formulary, found out my version got bumped to Tier 3. Went to my pharmacist, asked if they could switch me to the Tier 1 version. They said yes. Took 10 minutes. Saved me $40 a month. It’s not a battle, it’s a simple swap. Don’t panic. Just ask. Seriously. Pharmacies want to help. They just need you to speak up.

Craig Staszak

February 15, 2026 AT 08:21Been on a tiered plan for 8 years. Learned the hard way. Always check your formulary every October. Always. Even if you’ve been on the same drug for a decade. One year, my metformin went from $5 to $35. No warning. No email. Just a shock at the counter. I called my doc, asked for a switch. Approved same day. Now I’m back on the cheap one. It’s not complicated. Just tedious. And yeah, PBMs are shady. But you’ve got power. Use it.

alex clo

February 15, 2026 AT 13:52It is important to recognize that tiered formularies are not inherently nefarious. They serve as a mechanism to incentivize cost-effective prescribing. While the lack of transparency is problematic, the underlying economic model has demonstrably reduced overall pharmaceutical expenditures. The challenge lies in improving communication and patient education rather than dismantling the system entirely. A balanced approach is necessary.

Alyssa Williams

February 16, 2026 AT 10:22My mom got switched from her generic to a different one and didn’t know until her bill was $80 higher. She’s 72. Didn’t even know how to check her plan. I had to step in. Took me 20 minutes on the phone with the insurer. They said ‘it’s standard practice.’ No apology. No heads up. I called the pharmacy. They said ‘we’re allowed to switch.’ That’s not okay. This needs to change. You should be told. Period. End of story.

Ernie Simsek

February 18, 2026 AT 09:10LMAO this whole system is a joke 😂 PBMs are basically drug cartel middlemen. They don’t make pills, they just flip them like crypto. Your $5 generic? They sold the rebate rights to another company. Now you pay $45. Meanwhile, the PBM gets $12 from the manufacturer and keeps $10. You pay $45. They make $10. You’re paying for their vacation. 💸 This isn’t healthcare. It’s a pyramid scheme with stethoscopes.

Ojus Save

February 18, 2026 AT 19:22same thing happened to me with atorvastatin. i thought it was a mistake. called my doc. he said 'all generics are the same'. but the cost went from $3 to $42. i used goodrx and found out the cash price was $12. i paid cash for 3 months. now i know to always check. even if its 'the same' drug, the tier changes everything. dumb system.

Gloria Ricky

February 20, 2026 AT 11:38Just wanted to say-don’t let this stress you out. I used to freak out every time my copay changed. Now I just check GoodRx before I go to the pharmacy. If the cash price is lower than my copay? I pay cash. If not? I ask my pharmacist if they can switch me. Most of the time, they can. And if they can’t? I call my doc. It takes 5 minutes. You’ve got options. You’re not powerless. Seriously. You’re stronger than this system thinks you are.